"Promotion of my ethical jam company"

Betches

For The Group Chat

- Sound The Alarms: There's Actual Video Footage Of Kate Middleton

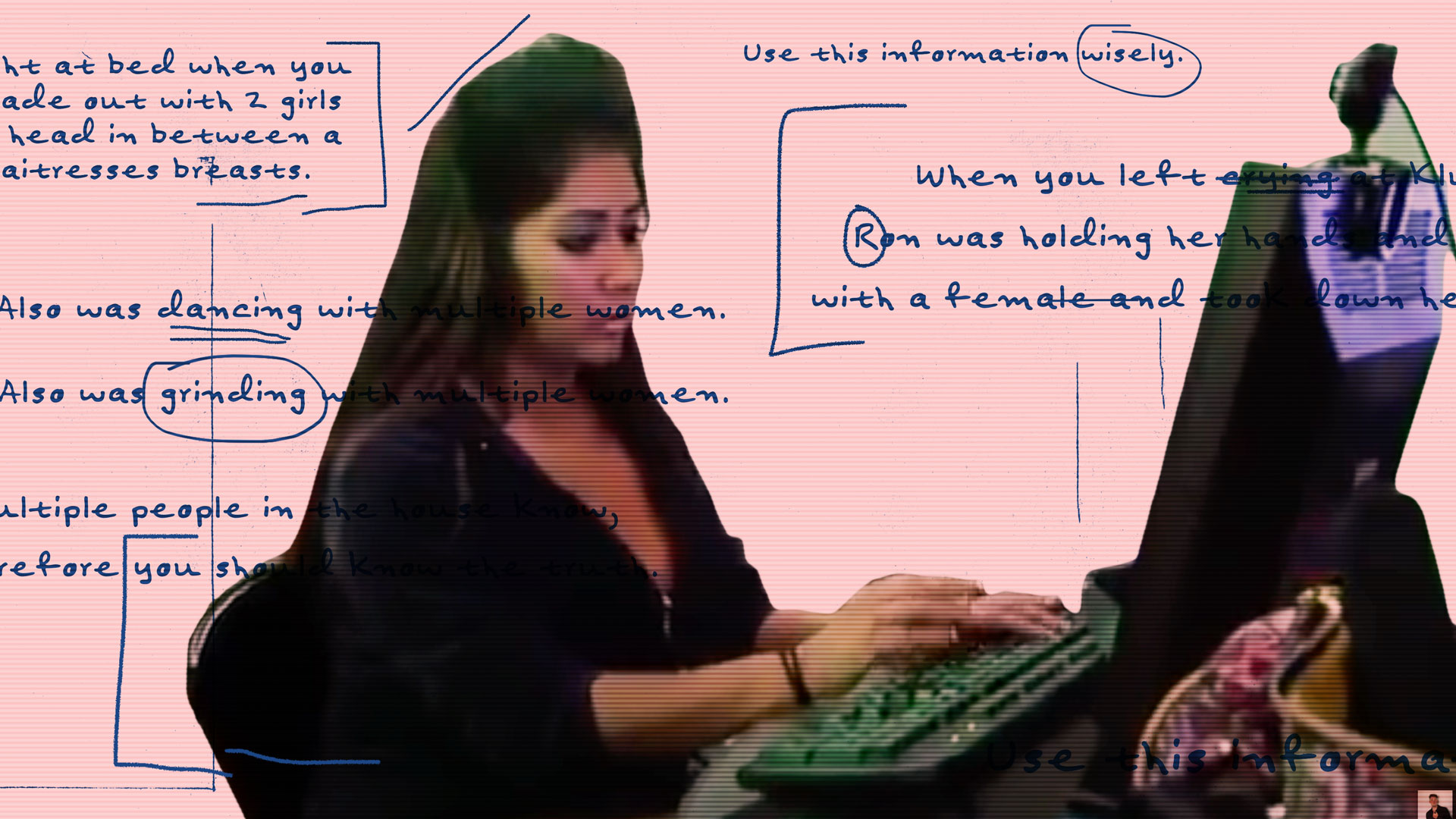

- Is Everything OK With Scheana And Brock?!

- PSA: These TikTok-Famous Products Are On Major Sale On Amazon

- The Way I Need Every Single Detail About Ayo Edebiri And Paul Mescal's Relationship

- Mom Hacks That Have Saved My Life (I Swear) And I'm Not Even A Mom Yet